Net income derived above MUR 650000 will be taxed at 15. The New Brunswick Low-Income Tax Reduction was implemented commencing 2001.

What Is The Standard Deduction Tax Policy Center

The Federal income tax has 7 rates.

. The Federal and Saskatchewan tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 124 a 24 increase. Local taxes on income. These tax changes.

Tax residents are subject to PIT on their worldwide employment income regardless of where the income is paid or earned at progressive rates from five percent to a maximum of 35 percent. Tax Adjustments and Credits. Personal income tax rates.

Information for Landlords. If you expect to owe 500 or more. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state.

26 April 2017 Rates allowances and duties have been updated for the tax year 2017 to 2018. There are no local taxes on income in Mauritius. 10 12 22 24 32 35 and 37.

The state has nine tax brackets as of the 2021 tax year. Income Tax liabilities of starting savers basic and higher rate taxpayers by largest source of income 16 March 2022 National statistics. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income.

Tax Rates - Current Marginal Tax Rates- Saskatchewan Personal Income Tax Rates Saskatchewan 2022 and 2021 Personal Marginal Income Tax Rates. 10 12 22 24 32 35 and 37. Ontario 2022 and 2021 Personal Marginal Income Tax Rates The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1024 a 24 increase.

As of 1 July 2018 the tax rate of 15 was reduced to 10 on annual net income derived by an individual of up to 650000 Mauritian rupees MUR. There are seven tax brackets for most ordinary income for the 2021 tax year. The lowest rate is 1 on annual incomes of up to 9325 for single filers 18650 for married and RDP filers and 18663 for head of household filers for the tax year 2021.

Rates allowances and duties have been updated for the tax year 2018 to 2019. The amount of tax you owe depends on your income level and filing status. Individual Income Tax Returns 1979 Income Concept Income Excluding DependentsThe 1979 Income Concept was developed to provide a more uniform measure of income across tax years.

2018 Individual Income Tax Brackets. These amounts are used to reduce tax payable. Eligible low-income families with dependent children may also receive the New Brunswick Child Tax.

By law businesses and individuals must file an income tax. Tax Rate Schedules and Tables. By including the same income and deduction items in each years income calculation and using only items available on Federal individual income tax returns the.

Previously the tax rate was raised from 3 to 5 in early 2011 as part of a statewide plan to reduce deficits. Tax credit amounts are multiplied by the lowest New Brunswick personal income tax rate to calculate the provincial tax credits. For tax years after 31 December 2019 an individuals total tax will be 95 of ones total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100000.

Your tax bracket depends on your taxable income and your filing status. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. The indexation factors tax brackets and tax rates have been confirmed to Canada Revenue Agency information.

The Illinois income tax was lowered from 5 to 375 in 2015. These tax rates are new and come from the Tax Jobs and Cuts Act of 2017 which was signed into law by President Trump on December 22 2017. If gross income is USD 100000 or less then the individuals total.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

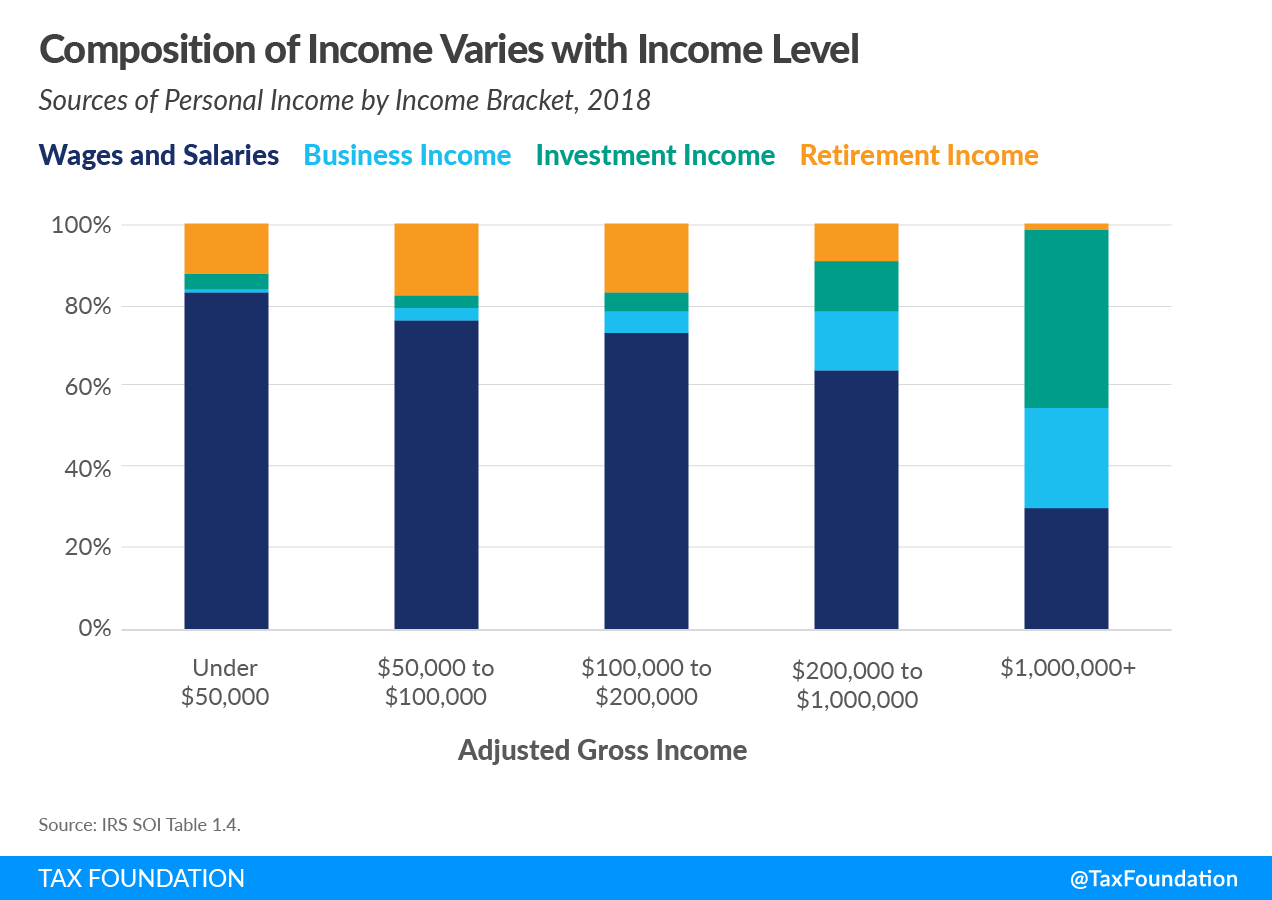

Sources Of Personal Income In The United States Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

Tax Cuts And Jobs Act Tcja Taxedu Tax Foundation

Taxtips Ca Business 2020 Corporate Income Tax Rates

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Sources Of Personal Income In The United States Tax Foundation

How Much Does A Small Business Pay In Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Who Pays U S Income Tax And How Much Pew Research Center

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

How Do State And Local Individual Income Taxes Work Tax Policy Center